2024 is a year of rapid development for AI, and all tech giants are “racing to grab territory.” In addition to frantically purchasing computing power, investment is also an important way for tech giants to enhance their own influence.

As the most important players in the AI industry, the investments of tech giants in the field of AI provide us with an excellent window to observe the AI industry.

The investments of tech giants in the field of AI not only reflect the differences in their AI strategies but also contain their latest judgments on industry trends.

Today, China AI headhunter SunTzu Recruit has summarized the investment situation of global tech giants in the AI field for 2024.

According to publicly available data, among all the tech giants, Nvidia and Google have made the most moves, with over 30 each. In addition, Microsoft, OpenAI, and Amazon have made 12, 7, and 6 moves respectively.

It is worth noting that due to different AI strategies, the investment performance of tech giants in the AI field is also completely different:

NVIDIA has invested in almost all leading AI companies, trying to firmly bind the entire AI industry with investments

Due to model anxiety, Microsoft continues to bet on large model companies;

Due to its strong self-developed models and a complete investment system, Google is focusing more energy on investing in AI applications;

OpenAI still has high hopes for embodied intelligence, seeking AI entry points into the physical world

Amazon founder Bezos personally intervenes, investing in several AI companies

Apple and Meta have been low-key, rarely taking action;

In addition to the differences in strategy, we can also see that these tech giants have reached a consensus in three subfields: healthcare, AI data, and embodied intelligence.

NVIDIA has made seven moves in the AI medical field, and OpenAI and Amazon also have corresponding layouts.

Next, let’s follow Mr. Crow to take a look at the AI investment landscape of tech giants in 2024.

01 NVIDIA: Net-style investment, heavily betting on AI healthcare

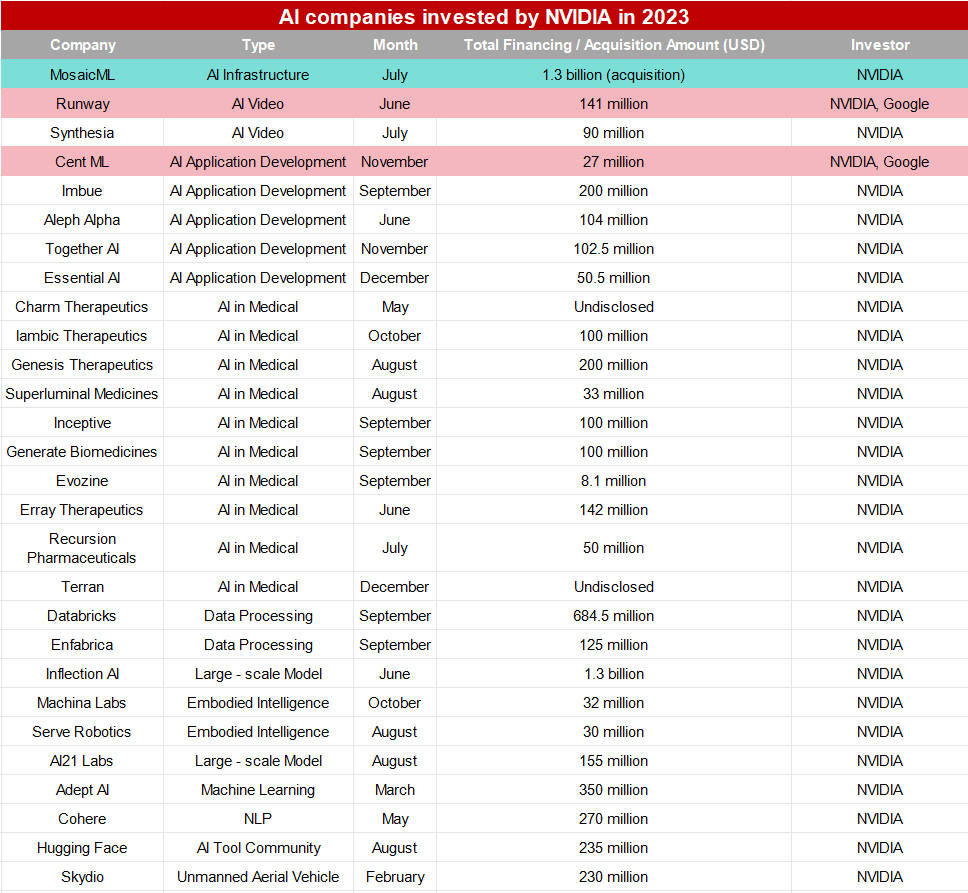

As the saying goes, great effort brings miraculous results. In 2024, Nvidia continued its strong attitude towards AI investment from last year.

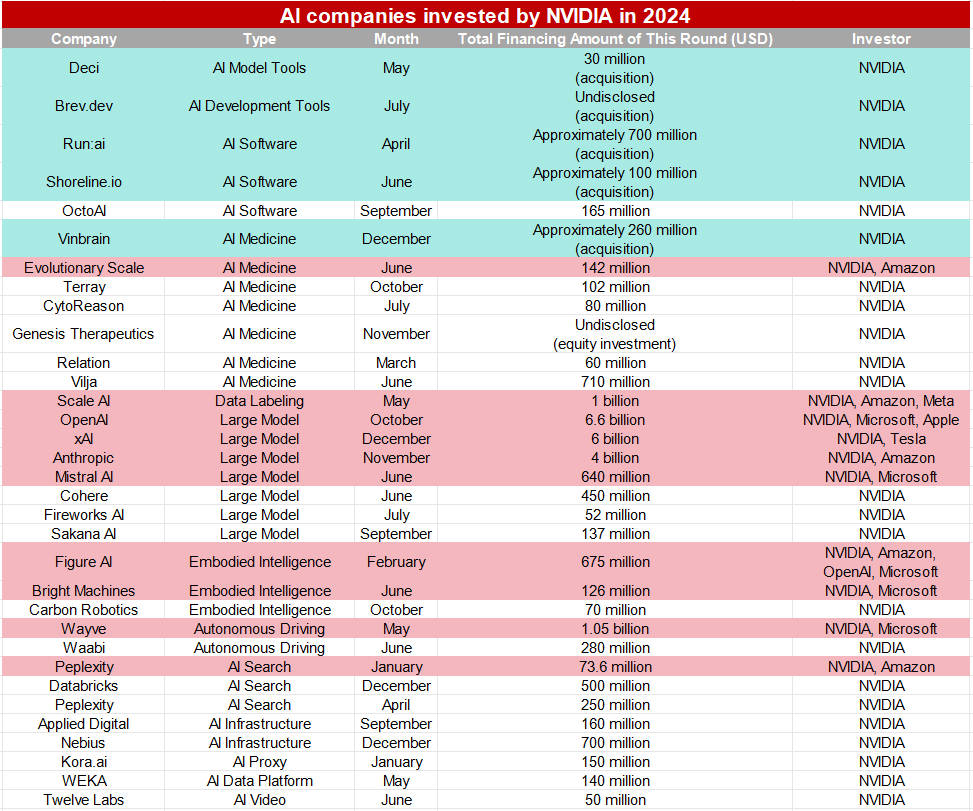

According to incomplete statistics from SunTzu Recruit, Nvidia invested in 33 AI projects in 2024, an increase of 15% compared to last year.

From these projects, Nvidia prefers to invest in leading companies in the AI field. In the rounds that Nvidia participated in, 22 projects had financing scales exceeding 100 million USD, and 5 projects even exceeded 1 billion USD. They are:

The large model company OpenAI has raised $6.6 billion in private equity financing

The large model company xAI raised $6 billion in Series C funding;

The large model company Anthropic raised $4 billion in strategic financing

Wayve, autonomous driving, Series C financing of $1.05 billion;

Data labeling Scale AI, Series F financing of 1 billion USD.

This includes top large model companies like OpenAI and Anthropic, as well as star companies in the AI field such as Databricks, Peplexity, Scale AI, and Figure AI.

The reason Nvidia bets on leading companies in the AI field is not hard to understand: using money to tie the best AI companies on the market to its own ship. The approach is simple and straightforward, but it is effective.

From the perspective of investment direction, large models and healthcare are the two most important investment areas for Nvidia.

Distribution of AI company types invested by Nvidia in 2024

In 2024, NVIDIA made six moves in the large model field, namely OpenAI, xAI, Anthropic, Mistral AI, Cohere, Fireworks AI, Sakana AI.

Another area of focus for NVIDIA is AI medicine. NVIDIA’s investment division, NVentures, invested in at least 10 AI pharmaceutical companies in 2023 and continued to increase its investment in 2024. In 2024, NVIDIA participated in at least 7 rounds of investment in AI pharmaceutical companies, namely Vinbrain, CytoReason, Evolutionary Scale, Genesis Therapeutics, Relation, and Vilya.

In June 2024, the largest AI medical financing case involving Nvidia occurred, with Evolutionary Scale, engaged in AI + protein structure prediction, raising $142 million in seed funding, with Nvidia’s NVentures participating.

In July, CytoReason, which develops disease research models, raised $80 million, with Nvidia as one of its investors;

In October, terray, focused on immunology, raised $120 million in Series B financing, marking NVIDIA’s second investment in the company.

In December, Nvidia also acquired a local Vietnamese AI medical company, Vinbrain, with a total value of 260 million dollars.

The reason why NVIDIA is so optimistic about the medical sector is closely related to Jensen Huang’s judgment on future trends. Jensen Huang has stated more than once in public that the future world will belong to life sciences.

Healthcare is also considered one of the best scenarios for the implementation of AI. The emergence of AI will completely transform the drug development process and improve the efficiency of new drug research and development.

Although only a dozen or so drugs have used artificial intelligence technology in the research and development process so far, this number may grow rapidly in the future, and drug development will increasingly resemble a computational problem. When data science, artificial intelligence, and automation are combined, biology will become engineered, with the potential for exponential growth.

02 Microsoft: Actively investing in large models, putting eggs in multiple baskets

Among all the tech giants, Microsoft is the most actively investing company in large models, apart from Nvidia.

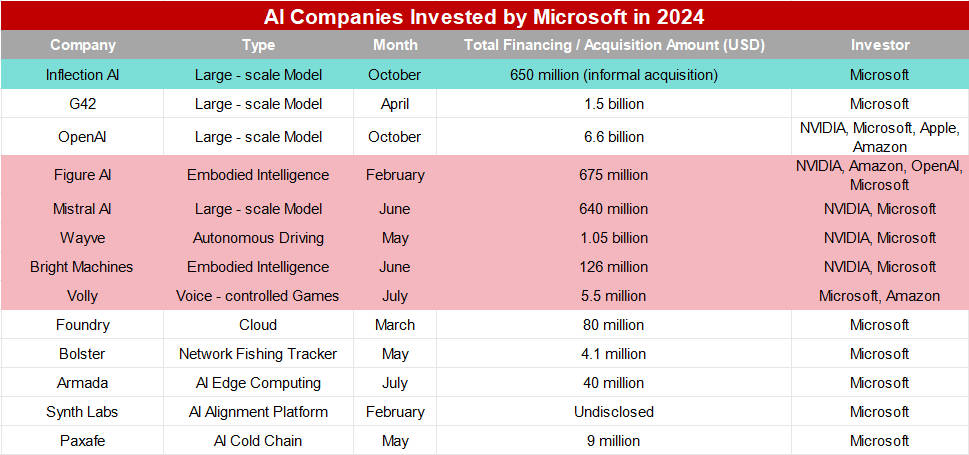

In 2024, Microsoft participated in the financing projects of 12 AI companies, including 3 large model companies: OpenAI, Mistral AI, and G42.

In addition, Microsoft spent $650 million to acquire Inflection AI. Inflection AI co-founders Mustafa Suleyman and Karén Simonyan, along with about 70 employees, collectively joined Microsoft, which even established a brand new department for them—Microsoft AI, responsible for Copilot and other consumer AI products.

This is closely related to Microsoft’s awkward position in the field of large models.

On one hand, Microsoft has made little progress in developing its own large models. On the other hand, with the rapid development of OpenAI, the differences between Microsoft and OpenAI are widening, forcing it to put its eggs in multiple baskets.

In addition, Microsoft has invested in two furniture intelligence companies, namely Bright Machines and Figure AI.

In addition to the main areas mentioned above, Microsoft has also invested in companies in various sub-sectors of other AI applications, such as voice-controlled game developers (Volly, $55 million), phishing trackers (Bolster, $41 million), AI alignment platforms (SynthLabs), and AI-driven cold chain technology companies (Paxafe, $9 million), among others.

03 Google: Most active, focusing on AI applications

Google is the company that has made the most moves among all the major tech firms.

According to China headhunter’s incomplete statistics, Google invested in more than 30 AI companies in 2024, including its acquisition of the AI virtual chatbot Character.AI.

This is attributed to Google’s comprehensive investment system. Google has three investment platforms: Google Ventures, Gradient Ventures, which focuses on investing in early-stage AI startups, and CapitalG, which focuses on growth-stage companies.

Specifically, Google has a wide range of investments, but rarely invests heavily in a single startup. From the total amount of financing in each round, the amount invested in each company may not be very large.

At the same time, China AI headhunter believes Google is placing more emphasis on the application of AI in various industries, including healthcare and biotechnology, enterprise management and production, law, payments, patents, and more.

Among them, in the AI legal sector, Google has invested in 6 companies, namely Lawhive, Harvey, Hebbia, Genie AI, Patlytics, and CaseMark.

Among them, Harvey, Hebbia, Genie AI, Patlytics, and CaseMark are all AI-based tools developed to improve efficiency for legal professionals, while Lawhive helps clients reduce costs and acquire customers by building an online legal service platform.

04 OpenAI: Made 7 moves, invested in embodied intelligence twice

As the highest-valued startup in the AI field, OpenAI has also made significant moves in 2024.

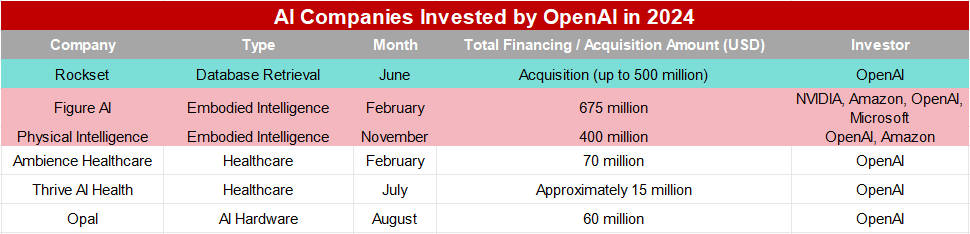

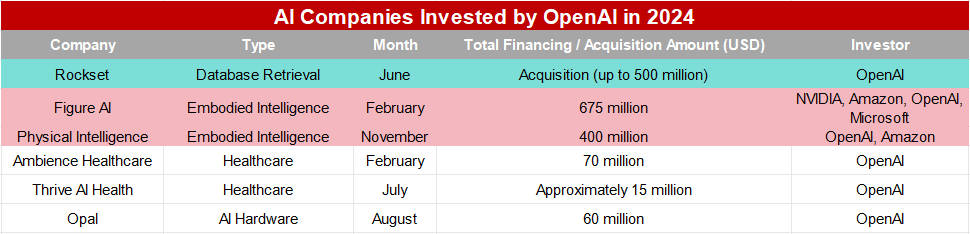

In 2024, OpenAI invested in 6 companies, including 2 in general intelligence, 2 in healthcare, 1 in AI hardware, and 1 in database retrieval.

Per OpenAI headhunter’s research, embodied intelligence is still one of the most valued tracks by OpenAI.

In February 2024, OpenAI invested in the humanoid robot company Figure, which is the second humanoid robot company that OpenAI has invested in.

In November, OpenAI invested in another artificial intelligence company, Physical Intelligence, which mainly builds “brains” for robots through AI models.

Guangzhou AI headhunter guesses that the reason OpenAI is focusing on this field is that embodied intelligence is likely to become an important channel for connecting the physical world.

In simple terms, with the hardware of robots, AI can have more access to external information, and this data may also feed back into AI algorithms. For example, the data accumulated by Tesla’s autonomous vehicles on highways nourished the FSD algorithm system, providing the most basic data foundation.

05 Amazon: The founder personally gets involved, ALL in AI

Amazon’s investment in the AI field can be seen as two parts: one part is the company’s investment activities, and the other part is the investment activities of its founder, Bezos Expeditions.

On March 27, Wednesday, Amazon announced an additional investment of $2.75 billion in the AI startup Anthropic, marking the largest venture capital investment in Amazon’s history.

According to data from the intelligence platform FINTRX regarding Bezos, all investments made in 2024 are in the AI field, with a total financing amount exceeding $1 billion. His investment actions in the AI field last year:

In January, participated in a $73.6 million Series B funding for AI search Perplexity, and in April invested another $63 million. Perplexity stated that its valuation soared to a maximum of $3 billion, and Bezos’s investment in April may have doubled compared to April.

In February, an investment was made in embodied intelligence Figure AI, with a total financing amount of $675 million.

In July, $300 million in Series A funding was invested in Skild AI, a company focused on creating AI systems for robotic devices.

In November, the robotics AI company Physical Intelligence secured $400 million in funding, bringing its post-financing valuation to $2.4 billion.

06 Low-key Apple and Meta

Among all the tech giants, Shenzhen AI headhunter agrees that Apple and Meta have been relatively low-key.

From public information, Apple only acquired DarwinAI in 2024. DarwinAI focuses on machine vision, which, in short, is using machines’ “eyes” for quality inspection in the manufacturing process. This company is dedicated to developing core technologies that make AI systems smaller and faster, which aligns with Apple’s need for running AI on devices.

Meta has only invested in the AI data company Scale AI. Clearly, compared to external investments, Meta is more willing to allocate resources to internal research and development.

Although Apple and Meta are not making many moves at the moment, Crow Lord believes that with the development of the AI industry, investment (and mergers and acquisitions) will become an increasingly important “weapon” in AI competition.

Different investment strategies will ultimately have a profound impact on the performance of these tech giants in the field of AI.

Comments are closed